Looking for the latest car price in Bangladesh (car price in BD) and why numbers move so much between “new”, “reconditioned”, and “hybrid”? This buyer’s guide breaks down the tax math, LC and forex effects, 2026 policy changes, realistic market ranges, and how to shortlist fast so you can buy with confidence.

Who this guide is for (and what you’ll learn)

If you’re a Bangladesh car buyer comparing showroom-new vs reconditioned Japan imports, or weighing hybrid vs petrol for Dhaka traffic, this guide explains:

What actually sets the car price in BD (taxes, LC rules, forex, supply channels)

2026 policy shifts that nudge prices (LC margin cuts; VAT relief for green tech)

Realistic price bands by segment: hatchbacks, sedans, SUVs, MPVs/vans

Smart ways to validate listings (auction sheets, hybrid battery health, JEVIC checks)

Which path minimizes the total cost of ownership (TCO) in Bangladesh right now

How car prices are set in Bangladesh

The tax–duty stack (why “on-road” climbs fast)

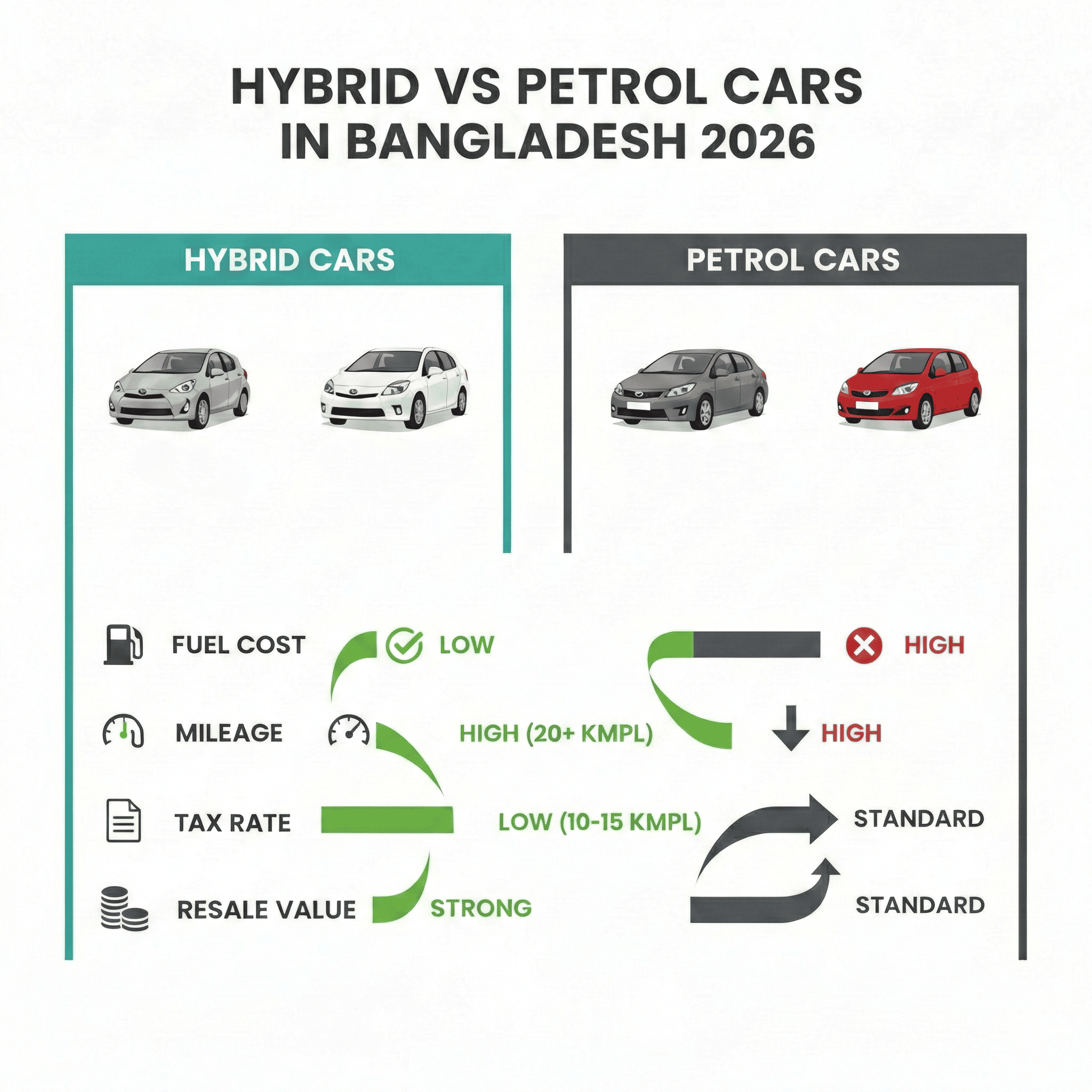

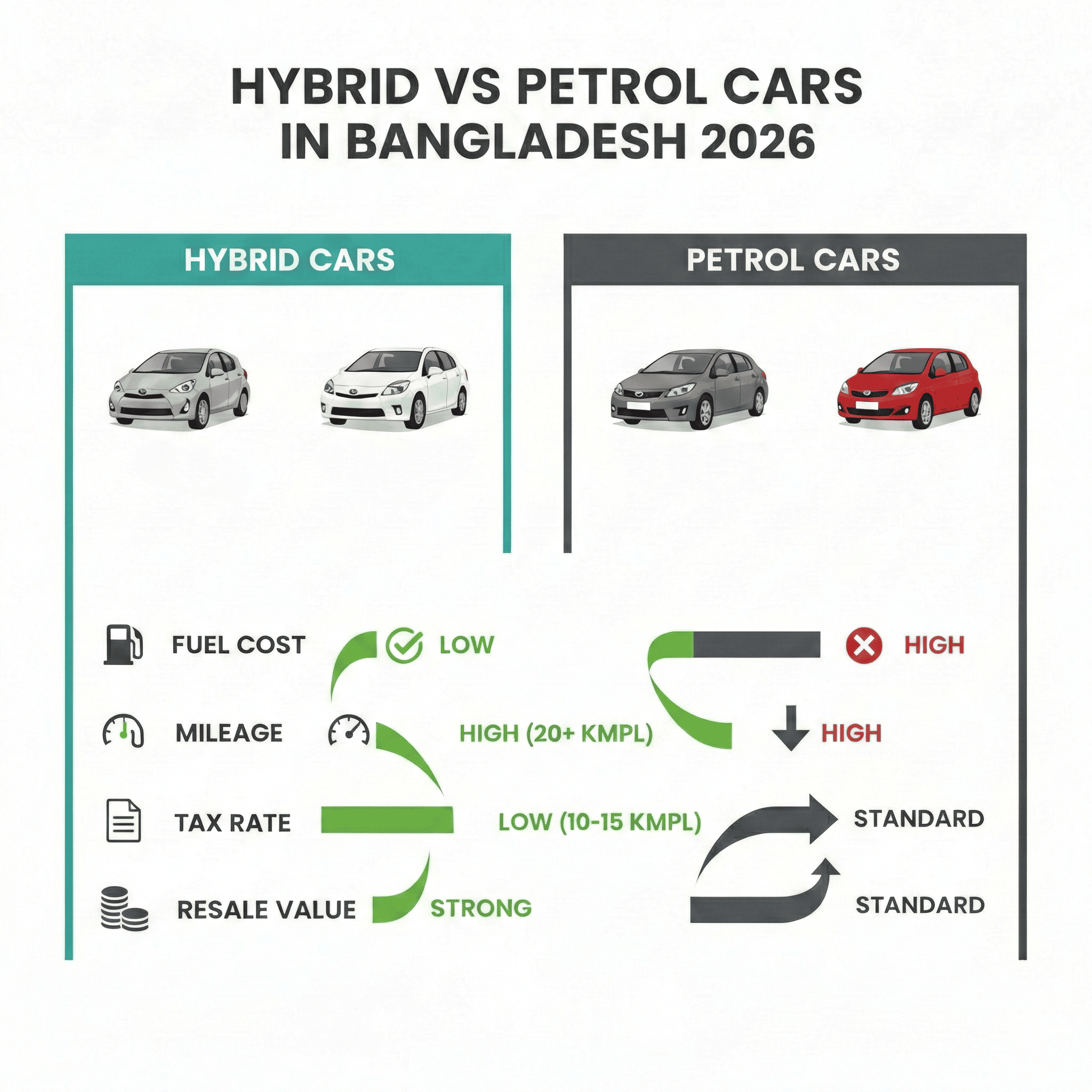

Imported vehicles face a layered incidence (customs duty, regulatory duty where applicable, supplementary duty, VAT, AIT, etc.). Rates vary by engine/motor capacity, age, and body type; that’s why the same model in two trims can land at very different prices. Hybrids and locally produced green tech enjoy added relief under current frameworks, which is why hybrid TCO often wins, especially for Dhaka city.

LC & forex impact (how macro turns into sticker price)

The LC cash margin required to open import LCs and the USD/JPY–BDT rates directly affect landed cost. When the yen strengthens or freight rises, list prices lift. Conversely, margin relief and steady yen can ease retail quotes in the following months. In early 2026, Bangladesh Bank reduced LC cash margins for cars to 50% (from 100%) a key liquidity improvement.

Supply channels shape the price ladder

Bangladesh is a mixed market:

Official new cars (limited SKUs, showroom warranty),

Reconditioned Japan imports (deep selection across years/grades, auction-verified),

Locally assembled models (growing, pushing competitive pressure into adjacent segments). That blend is why you see wide price ranges for the same nameplate.

2026 policy shifts every buyer should know

LC margin cut (why the stock is easing)

Bangladesh Bank’s instruction cutting LC margins for motorcars to minimum 50% improved importer liquidity. For EVs and hybrids, banks can set margins based on the banker–customer relationship, accelerating green-vehicle availability. Expect a gradual, not instant, effect on price tags as new shipments clear.

VAT incentives for green mobility (through 2030)

The 2025–26 budget framework continues VAT relief for locally produced vehicles and hybrid/EVs (conditional), and extends incentives for lithium/graphene battery production—zero or reduced VAT now, stepping to a modest rate later. Net result: improving economics for hybrids/EVs and local manufacturing that can indirectly temper prices.

EV registration & annual tax (how kW maps to “cc”)

Bangladesh finalized Electric Motor Vehicle Registration & Operation Guidelines (2023), including annual tax bands using a conversion of 1 kW ≈ 20 cc for assessment. If you’re cross-shopping a hybrid/EV, knowing the category and band protects you from surprises at registration.

Market signals: local assembly & hybrid momentum

Local manufacturing and hybrid launches are reshaping expectations. Hyundai’s local plant helped it jump to market leadership among brand-new cars in 2023 while cutting list prices, evidence that localization can pull the market lower. BAAMA continues to push for EV-friendly duty structures to hit the 2030 green-mobility targets.In parallel, mainstream launches have accelerated the hybrid curve: Suzuki Grand Vitara Full Hybrid arrived with strong-hybrid tech and safety suites, normalizing higher-mix hybrid demand in the mid-size SUV class.

And Rancon Auto launched the first made-in-Bangladesh Mitsubishi Xpander in mid-2026 lowering price points in family MPVs and adding pressure across adjacent segments.

Price reality in 2026: segment-by-segment ranges

Note: Bangladesh pricing is dynamic. Ranges below reflect typical market listings and duty math for good-condition units; spec/grade, mileage, ADAS packages, and battery health (hybrids) move numbers meaningfully.

A) Compact hatchbacks (city-first, rideshare-friendly)

Hybrid hatch (e.g., Toyota Aqua): ~ Tk 18–28 lakh (reconditioned). City economy of ~25–30 km/L and inexpensive upkeep make this a perennial Dhaka favorite.

Petrol hatch (e.g., Vitz/Yaris class): ~ Tk 12–20 lakh (older KSP/NCP to newer).

Use cases: first-time buyers, daily commuters, gig/ride-share drivers balancing payment + fuel.

B) Sedans (comfort + economy)

Toyota Axio (hybrid/petrol): ~ Tk 18–32 lakh depending on grade (WXB/G) and year.

Toyota Prius (hybrid): ~ Tk 25–45 lakh (iconic hybrid with excellent highway economy).

Toyota Camry (hybrid/petrol): ~ Tk 45–75 lakh (executive comfort).

Use cases: families, corporate chauffeurs, inter-district travelers who value quiet cabins and mileage.

C) Crossovers/SUVs (ground clearance + family duty)

Toyota CH-R (hybrid): ~ Tk 27–45 lakh (S/GT, Toyota Safety Sense).

Toyota Corolla Cross (hybrid): official pricing varies by trim; reconditioned 2022–23 units often Tk 45–65 lakh subject to options.

Toyota Harrier / RAV4 (hybrid/petrol): ~ Tk 45–85 lakh depending on series and AWD.

Use cases: school runs + highway trips, luggage space, and ADAS for fatigue reduction.

D) Body-on-frame 4×4 (durability + status)

Use cases: rough-road duty, rural routes, factories, NGO/embassy fleets.

E) MPVs & vans (schools, staff, tourism, cargo)

Toyota Noah/Esquire (hybrid): ~ Tk 30–55 lakh—family/rideshare workhorses.

Alphard/Vellfire (hybrid): ~ Tk 90–160 lakh—lounge-class MPVs.

Toyota Hiace (petrol/diesel): ~ Tk 35–80 lakh—the shuttle backbone for schools, hotels, and tour operators.

Use cases: bigger families, school transport, hospitality fleets, logistics where uptime and resale matter.

Why prices differ so much (even for the same model)

Duty structure & banding: CIF values, supplementary duty, and VAT create step-changes between engine sizes/ages. Hybrids/EVs benefit under the current incentive direction

LC margin & FX: Post-2026 LC relief (50%) helps, but yen/dollar rates and freight still drive volatility.

Spec literacy: Japan-market trims (e.g., WXB vs G), ADAS packages (Toyota Safety Sense), wheels, leather, JBL audio, panoramic roof can produce a 10–30% swing.

Hybrid battery health: Verified state-of-health + cooling fan maintenance history commands a premium but slashes long-run cost.

Resale momentum: Aqua/Axio/Prius/Corolla Cross enjoy robust resale networks; strong residuals support higher list prices today but lower lifetime cost.

TCO in Bangladesh: budget beyond the sticker

Fuel: Hybrids commonly deliver ~25–30 km/L in Dhaka stop-start conditions for Aqua/Prius/Axio Hybrid; crossovers like CH-R/Corolla Cross also show meaningful gains over petrol peers.

Maintenance: Plan roughly Tk 70k–120k/year for typical daily drivers; SUVs/4×4 and luxury MPVs trend higher.

Insurance & registration: Engine/motor band, vehicle value, and usage city affect annual totals; EVs/hybrids fall under the 2023 EV registration framework (1 kW ≈ 20 cc reference for tax).

Hybrid battery: Many Toyota hybrid packs run beyond 150,000–200,000 km in Bangladesh conditions with sensible maintenance (fan cleaning, heat management).

City vs highway economics: why hybrids win the commute

Dhaka’s congestion punishes petrol-only cars. Regenerative braking and electric launch make hybrids dramatically cheaper per km in city cycles. On highways, hybrids still save, though the gap narrows. If your routine mixes Mirpur–Motijheel commute with weekend Sylhet/Chattogram trips, hybrids deliver a consistent TCO edge in 2026, especially with policy tailwinds.

Buying paths: official showroom vs importer vs marketplace

Official distributor: best for buyers wanting zero-owner history, factory warranty, campaign finance, and fixed, well-optioned trims (e.g., current-gen Corolla Cross).

Importer/reconditioned: the deepest selection by year/grade/mileage, and usually the best value for total cost over 3–5 years—provided you verify documentation and battery health.

Marketplaces: broaden options and price discovery; treat listings as guideposts and always insist on independent inspection.

How to validate a listing (and avoid expensive surprises)

Auction sheet (original, verifiable)—check grade, repair codes, and odometer.

JEVIC inspection confirms mileage/condition integrity.

Hybrid battery health report plus proof of fan/duct cleaning.

Service records oil, CVT fluid, brake wear, tyres aligned with mileage.

Chassis checks, recalls cleared, water/flood markers absent.

Timing the market in 2025–26

LC margin relief and green VAT incentives are supportive, but FX and shipping remain variables. If you find the right spec + verified history at a fair number, don’t over-optimize timing—inventory turns quickly in the segments with the best resale.

Actionable shortlists by use case

Lowest monthly spend (city): Reconditioned Aqua/Axio Hybrid/Prius hybrid mileage and parts abundance win.

Family comfort + efficiency: Corolla Cross/CH-R Hybrid, or Noah/Esquire for sliding-door practicality.

Business fleets & logistics: Hiace for people/cargo moves; Fortuner/Prado for mixed roads and durability.

Why Choose Carbarn Bangladesh

If you want the confidence of Japan-side verification plus local after-sales, start your shortlist at Carbarn Bangladesh. Our stock prioritizes the models Bangladesh buyers actually need hybrid city cars for fuel savings, family crossovers for comfort and safety, and vans/MPVs for school and fleet duty. Every vehicle is auction-sheet verified, JEVIC-inspected, and evaluated for hybrid battery health. We walk you through registration, insurance, and delivery from Dhaka to Chattogram and beyond so your total cost of ownership stays low from day one. When you’re comparing car price in BD, the right partner matters as much as the right car; with Carbarn, you get both.

References

Bangladesh Bank LC margin relief coverage (50% for cars; special handling for EV/hybrids).The Financial Express+1

Budget 2025–26 VAT incentives for green mobility and batteries (policy note).BRTA

EV registration & kW–cc banding in BRTA guidance (2023).The Business Standard